PMYB&ALS – Prime Minister’s Youth Business & Agriculture Loan Scheme 2026

The Prime Minister’s Youth Business & Agriculture Loan Scheme (PMYB&ALS) is one of Pakistan’s most impactful financial empowerment initiatives aimed at supporting young entrepreneurs and farmers. The program provides affordable financing to help youth start businesses, expand existing ventures, and strengthen the agriculture sector.

Launched under the government’s youth empowerment vision (نوجوانوں کو بااختیار بنانا), PMYB&ALS focuses on reducing unemployment (بے روزگاری), promoting self-employment (خود روزگار), and boosting economic growth.

What is PMYB&ALS?

PMYB&ALS is a government-backed loan program designed to:

- Support young entrepreneurs (نوجوان کاروباری افراد)

- Strengthen the agriculture sector (زرعی شعبہ)

- Encourage small and medium enterprises (SMEs)

- Promote financial inclusion (مالی شمولیت)

The scheme provides subsidized and low-markup loans through participating banks across Pakistan.

Objectives of the Scheme

The key goals of PMYB&ALS include:

Youth Empowerment

Providing financial access to young individuals who want to start their own businesses but lack capital.

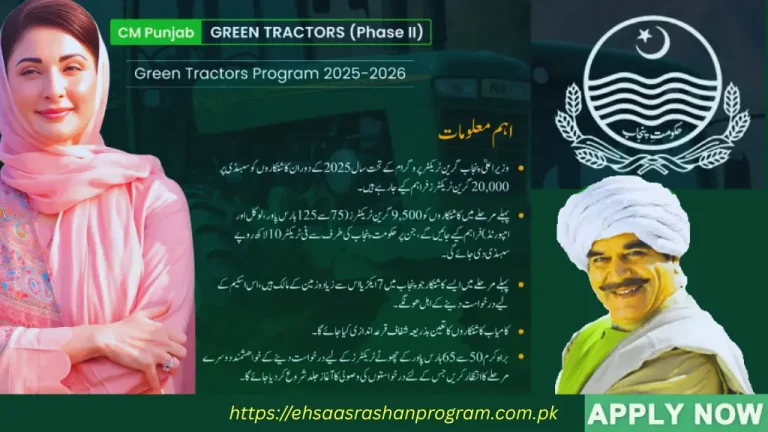

Agriculture Development

Supporting farmers (کسان) with loans for:

- Seeds and fertilizers

- Livestock (مویشی پالنا)

- Tractors and farm machinery

- Irrigation systems

Job Creation

Encouraging startups that create employment opportunities across Pakistan.

Economic Stability

Strengthening small businesses and agriculture to stabilize the national economy.

Also read PM Announces Solar Power Scheme for Gilgit-Baltistan

Loan Categories & Tiers

The scheme usually offers loans in multiple tiers:

Tier 1

- Small loans (e.g., up to Rs. 0.5 million)

- Lower markup

- Ideal for startups and small vendors

Tier 2

- Medium loans (e.g., Rs. 0.5 million to Rs. 1.5 million)

- For expanding small businesses

Tier 3

- Larger loans (up to several million rupees)

- For established businesses or agricultural investments

(Exact limits may vary depending on policy updates.)

Eligibility Criteria

To apply for PMYB&ALS, applicants must:

- Be a Pakistani citizen

- Have a valid CNIC

- Fall within the eligible age bracket (usually 21–45 years; agriculture may have relaxed limits)

- Have a viable business or agriculture plan

- Meet basic credit requirements

Women entrepreneurs (خواتین کاروباری افراد) and differently-abled persons may receive special consideration.

Sectors Covered Under PMYB&ALS

The scheme supports multiple sectors including:

- Agriculture & Livestock

- Dairy farming

- Poultry farming

- Fisheries

- Manufacturing

- IT & Freelancing

- Retail businesses

- E-commerce startups

This wide coverage makes it one of the most inclusive youth loan schemes in Pakistan.

Prime Minister’s Youth Business & Agriculture Loan Scheme

How to Apply for PMYB&ALS

The application process is straightforward:

- Visit the official PMYB&ALS online portal.

- Create an account using your CNIC and mobile number.

- Fill out the loan application form.

- Submit required documents (business plan, income details, etc.).

- Choose your preferred bank.

- Wait for verification and approval.

After approval, the selected bank processes the loan disbursement.

Required Documents

Applicants typically need:

- Valid CNIC

- Recent photograph

- Business plan

- Income details

- Bank account information

- Agricultural land documents (if applicable)

Benefits of PMYB&ALS

Low markup rates

Flexible repayment plans

Encourages entrepreneurship (کاروباری مواقع)

Supports rural and urban youth

Promotes agricultural modernization

The scheme helps turn ideas into income and supports Pakistan’s transition toward a stronger SME and agriculture-based economy.

Challenges & Considerations

While PMYB&ALS is highly beneficial, applicants should:

- Ensure their business plan is realistic

- Understand repayment obligations

- Maintain proper documentation

- Avoid loan misuse

Proper financial planning increases the chances of long-term success.

Conclusion

The Prime Minister’s Youth Business & Agriculture Loan Scheme (PMYB&ALS) represents a major step toward youth empowerment and economic development in Pakistan. By offering accessible financing, the program enables young entrepreneurs and farmers to build sustainable livelihoods.

If you are a motivated young individual with a business or agricultural idea, PMYB&ALS can provide the financial boost needed to turn your vision into reality.

One Comment